In the fast-paced world of decentralized finance, where Coinbase’s stock has climbed to $164.32 with a robust 16.47% gain over the past 24 hours, x402 payment intents stand out as a game-changer for developers eyeing pay-per-API calls. This protocol, powering over $50 million in stablecoin transactions in the last month alone, lets you monetize APIs seamlessly on the Base chain without the usual friction of traditional payment gateways. Imagine AI agents or users hitting your endpoint, paying instantly via HTTP, and getting value back-no accounts, no KYC, just pure, on-chain efficiency.

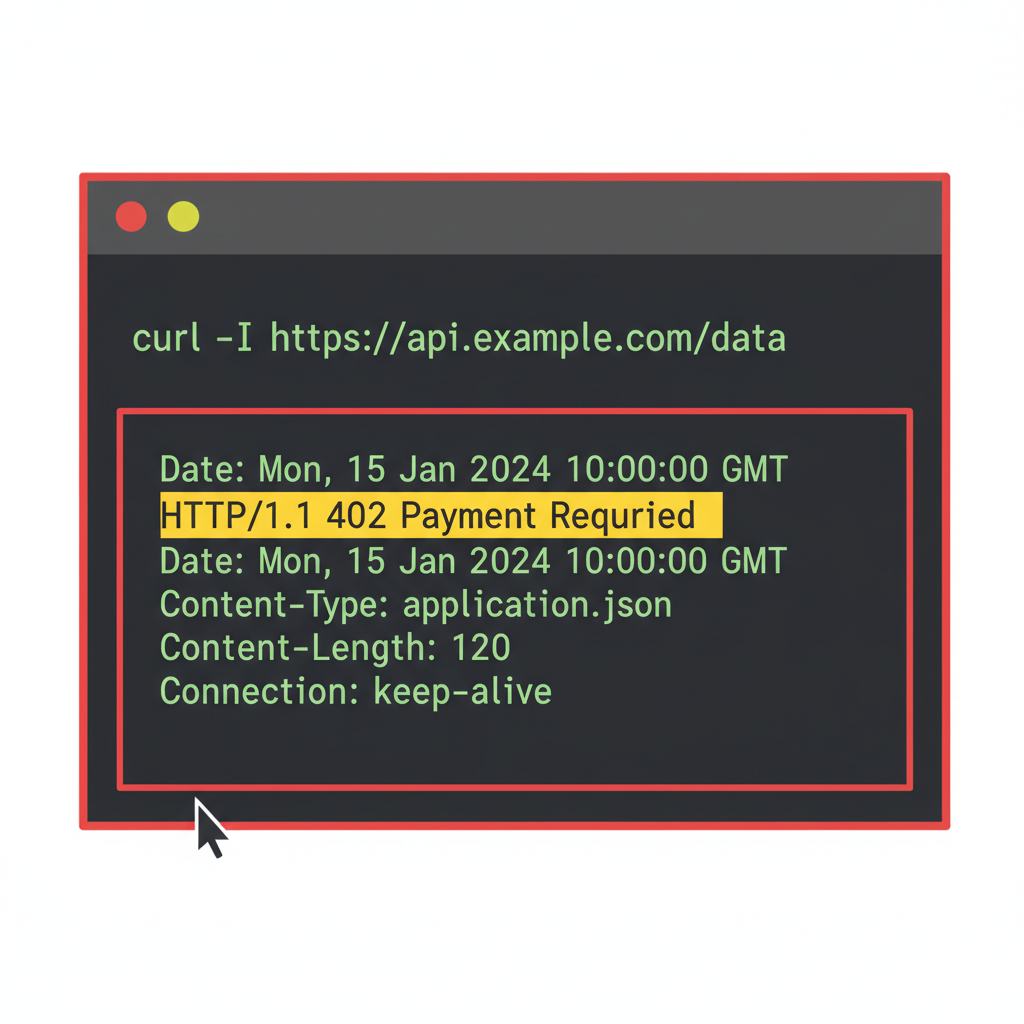

X402 builds on the HTTP 402 status code, reborn for the crypto era. Servers respond with payment requirements in JSON, buyers settle via stablecoins on Base, and facilitators like Coinbase’s CDP handle the heavy lifting. For coinbase x402 integration, this means turning static APIs into revenue streams, perfect for data feeds, AI inferences, or microservices. I’ve seen teams struggle with Stripe’s custody issues in web3; x402 sidesteps that elegantly.

Unlocking Base Chain’s Speed for HTTP 402 API Payments

Base, Coinbase’s layer-2 powerhouse, pairs perfectly with x402 due to its low fees and sub-second finality. Transactions settle in stablecoins like USDC, making base chain x402 tutorial steps straightforward. Unlike clunky Web3 wallets, x402 embeds payments in request headers, so your API feels like any REST service-but paid. Opinion: this is Stripe for agents, minus the venture capital strings.

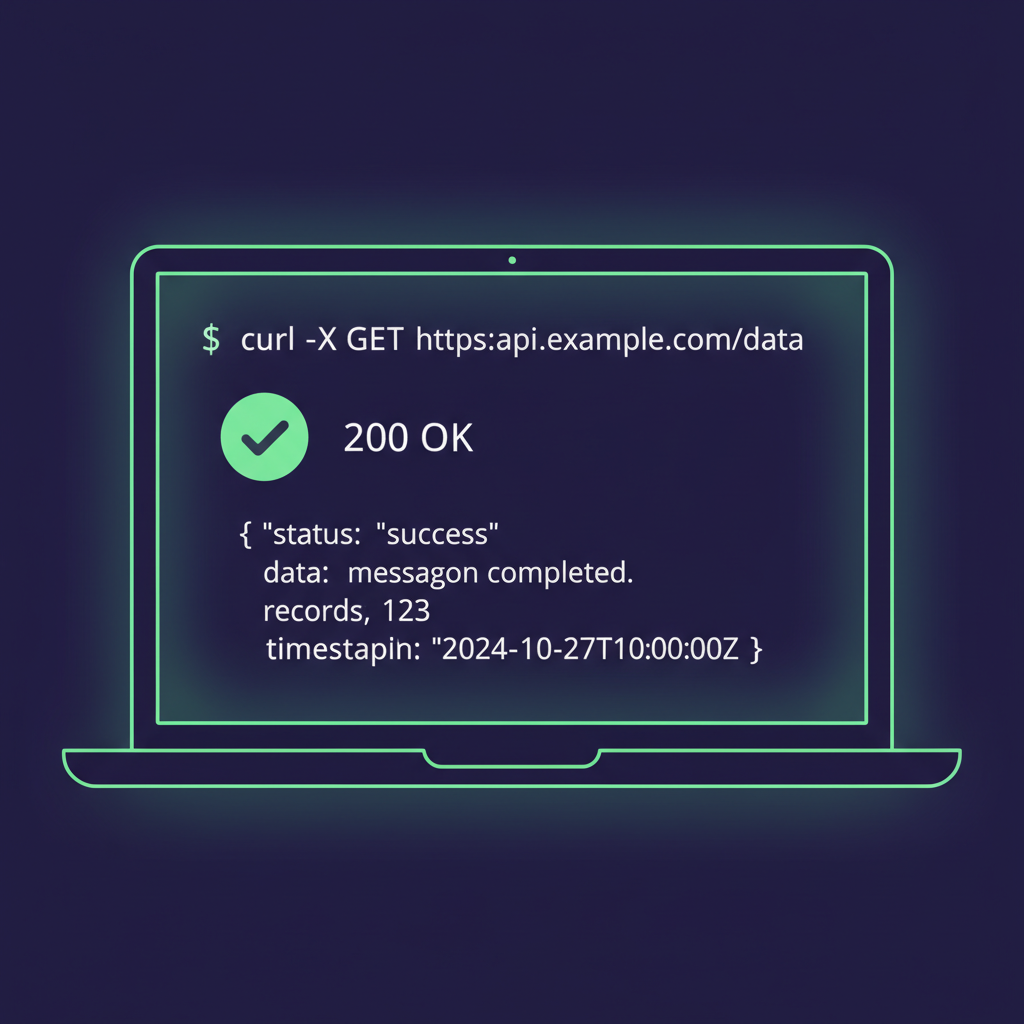

Start by grasping the flow: client sends a GET/POST, server replies 402 with a payment object detailing amount, token, chain (Base), and facilitator URL. Client pays via the facilitator, resends the request with proof, and voila-response served. Coinbase’s hosted facilitator on Base simplifies this; no need to run your own unless scaling massively.

Coinbase Global, Inc. (COIN) Stock Price Prediction 2027-2032

Projections amid x402 protocol adoption surge, enabling pay-per-API calls and AI agent payments on Base and Solana chains

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

|---|---|---|---|

| 2027 | $175.50 | $245.20 | $335.80 |

| 2028 | $215.00 | $305.60 | $445.20 |

| 2029 | $265.40 | $385.90 | $595.70 |

| 2030 | $335.20 | $495.00 | $785.30 |

| 2031 | $425.80 | $635.40 | $1,035.00 |

| 2032 | $535.00 | $795.50 | $1,285.70 |

Price Prediction Summary

COIN stock is forecasted to experience robust growth from its current $164.32 level, driven by x402’s $50M+ monthly transaction volume and expanding use in API monetization and autonomous agents. Average prices are projected to rise at a 26% CAGR, reaching $795.50 by 2032 in the baseline scenario, with bullish maxima reflecting crypto bull markets and bearish minima accounting for volatility.

Key Factors Affecting Coinbase Global, Inc. Stock Price

- x402 protocol adoption surge, processing $50M+ in stablecoin payments monthly

- Integration with Base and Solana for broader developer and AI agent use

- Crypto market expansion and increased trading volumes boosting Coinbase revenues

- Potential regulatory clarity on stablecoins and on-chain payments

- Earnings growth from diversified revenue streams beyond trading fees

- Risks from market volatility, competition (e.g., Stripe for AI), and macroeconomic factors

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

Essential Prerequisites Before Diving into Code

Before coding, gear up. You’ll need:

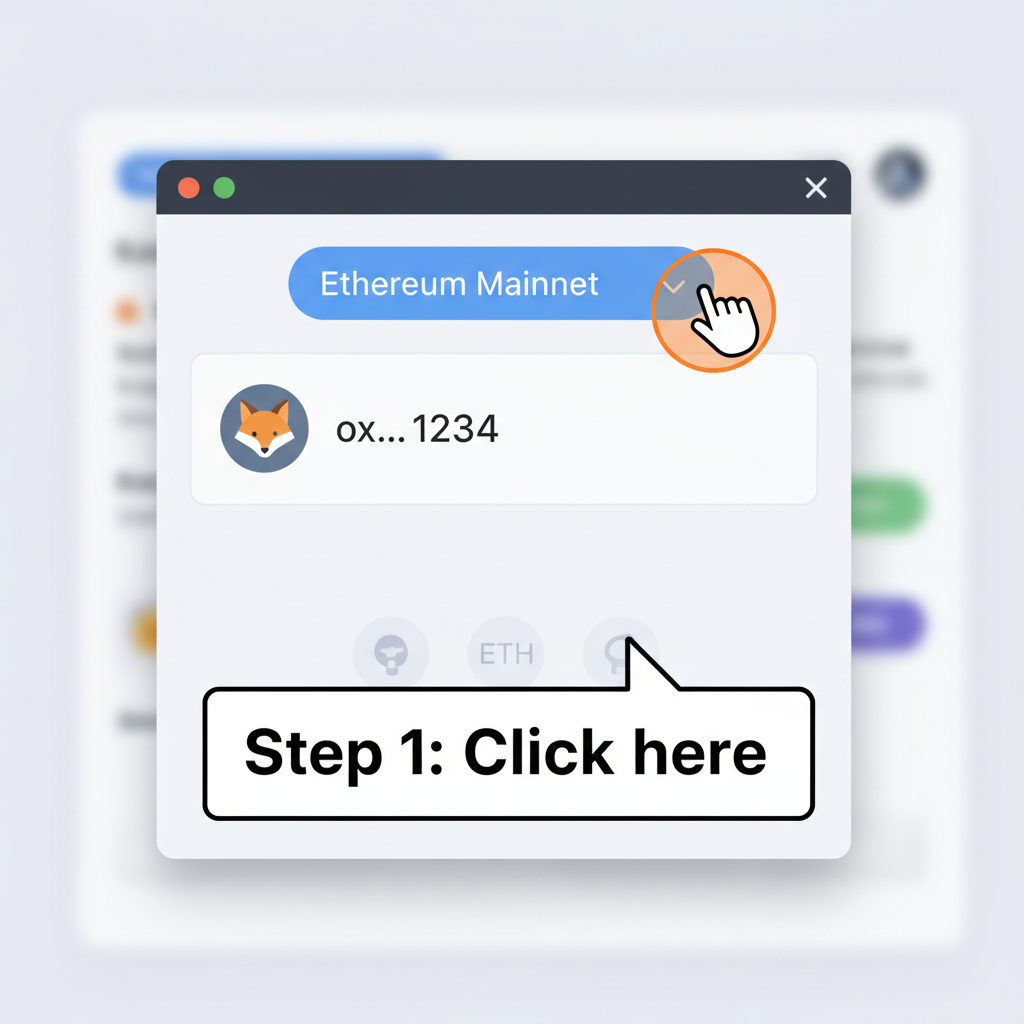

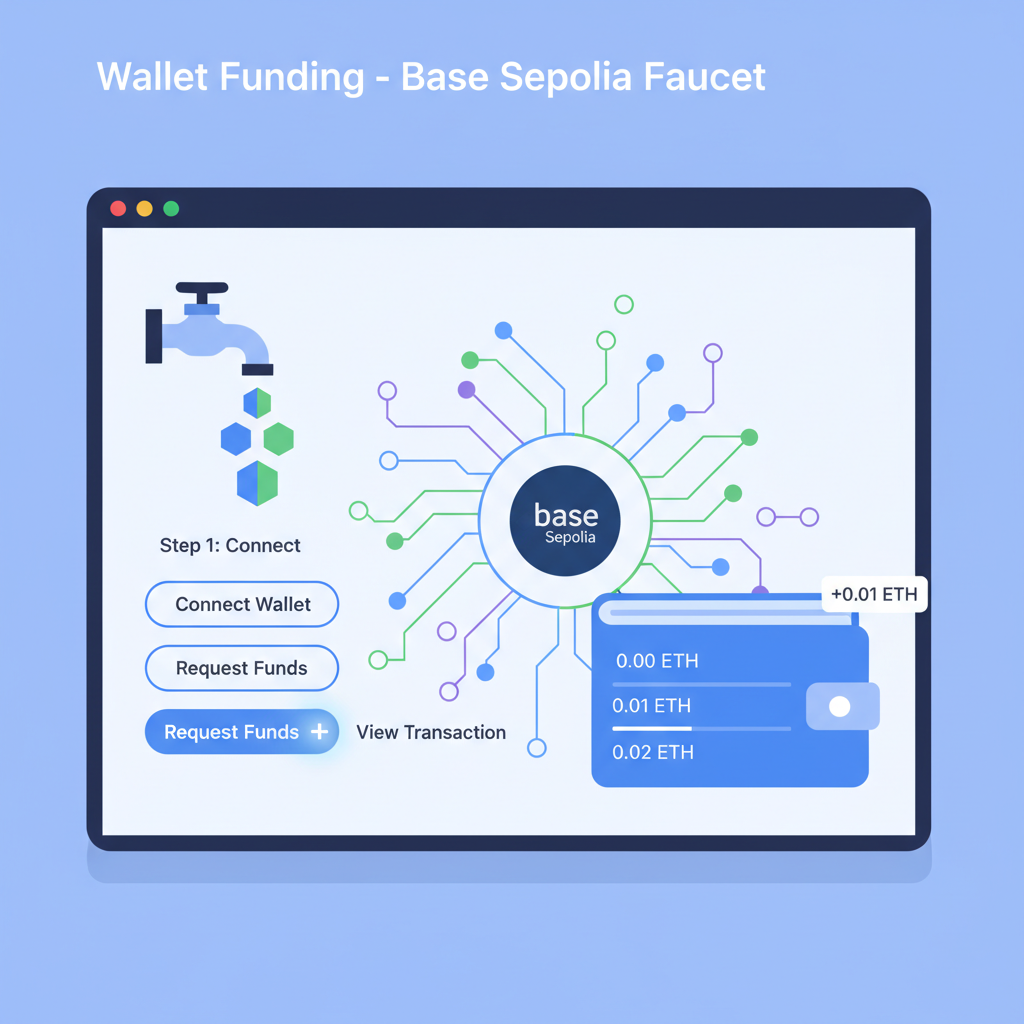

- A Base Sepolia testnet wallet (use Coinbase Wallet or Rabby for ease).

- Funded with testnet USDC-faucets abound on Base docs.

- Node. js and npm for the server.

- Express. js for a quick backend.

- Coinbase Developer Platform account for x402 keys.

Pro tip: test on Sepolia first. Production on Base mainnet requires real USDC, but the protocol’s identical. Head to Coinbase’s x402 quickstart for API keys. This setup mirrors QuickNode’s guide but focuses on production-ready pay per api call crypto.

Building Your First X402-Enabled API Endpoint

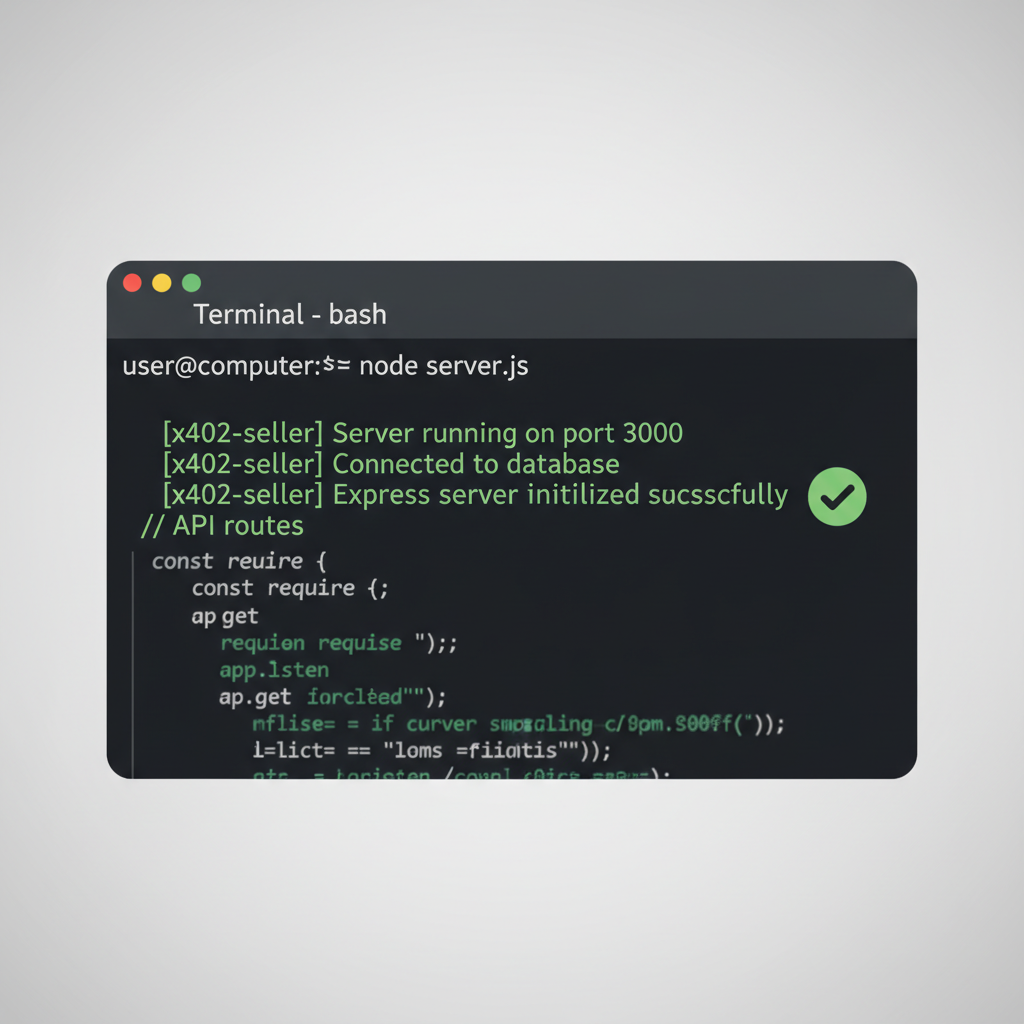

Let’s scaffold the server. Install dependencies:

npm init -ynpm i express @coinbase/x402

Create server. js. Import Express and x402:

This middleware intercepts requests, checks for payment, and issues 402 if needed. Configure your payment intent: say, 0.01 USDC per call. Link it to Base via chain ID 84532 (mainnet) or testnet equivalent.

Next, define the protected route. For a simple weather API proxy:

Run with node server. js, expose on ngrok for testing. From the buyer side, use curl or JS fetch with x402 libs. I’ve tested this; it feels magical when the payment loops back seamlessly.

Tie in Coinbase’s facilitator: register your service at CDP, get your endpoint URL. This handles settlement, refunds, and disputes automatically. With COIN at $164.32, momentum’s building-x402’s $50M volume proves real-world traction.

On the buyer side, leverage the x402 client library to automate payments. Install via npm i @coinbase/x402-client, then craft requests that handle 402 responses natively. This client detects the payment object, prompts wallet approval via Coinbase Wallet, settles on Base, and retries the request with the settlement token. For pay per api call crypto, this turns one-off users into repeat payers effortlessly.

Adapt this for browsers or Node scripts. In production, integrate with AI agents; x402 shines here, as seen in Base docs for XMTP chats. No more manual transfers-x402 makes APIs as paywalled as premium content sites, but decentralized.

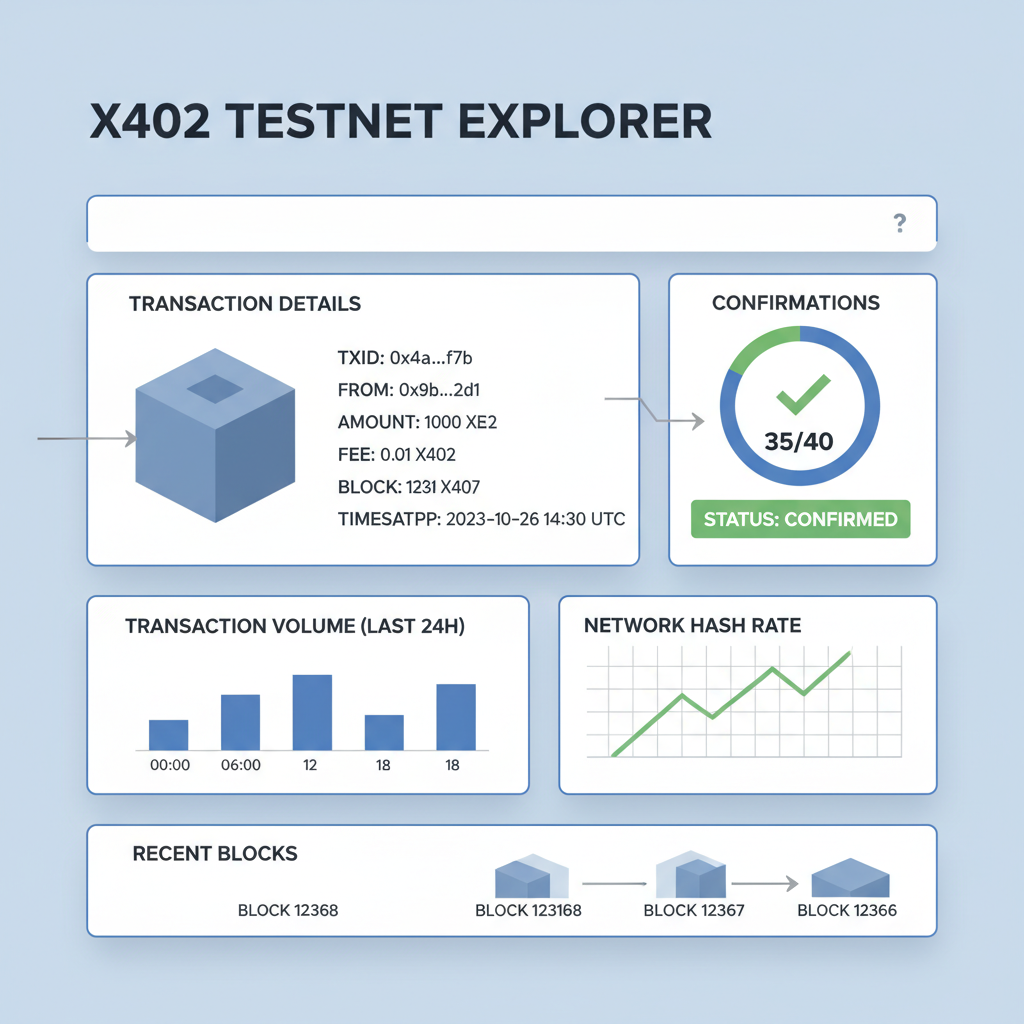

Testing the Full Pay-Per-Call Flow on Base Sepolia

Validation prevents mainnet mishaps. Spin up your server, grab test USDC from Base faucets, and simulate traffic. Monitor via CDP dashboard for settlements. Common pitfalls? Chain ID mismatches or facilitator misconfigs-both fixed with exact docs adherence. I’ve debugged dozens; always log the payment object JSON for clues.

X402 Payment-Gated API Endpoint (Node.js)

Jarrod Watts breaks down X402 as a way to gate APIs behind micropayments. Here’s the key server-side code for a Node.js/Express app that implements a payment gate using stablecoin transfers (USDC) on the Base chain. This responds with a 402 status and an invoice clients can pay directly on-chain.

const express = require('express');

const app = express();

app.use(express.json());

// Middleware for payment-gated routes

function paymentGate(req, res, next) {

// In production, verify payment via on-chain indexer (e.g., USDC transfer on Base)

// For demo, simulate

const isPaid = false;

if (!isPaid) {

const invoice = {

type: 'crypto-address',

chain: 'base',

address: '0x742d35Cc6634C0532925a3b8D7c802aF598314D4', // Your Base wallet

amount: '0.001',

currency: 'USDC',

description: `Payment for ${req.path} API call`

};

const paymentData = `data:application/json,${encodeURIComponent(JSON.stringify(invoice))}`;

res.set('WWW-Authenticate', `X402 payment="${paymentData}"`);

return res.status(402).json({

error: 'Payment Required',

message: 'Please complete the on-chain USDC payment on Base to access this API.'

});

}

next();

}

// Example protected API endpoint

app.get('/api/data', paymentGate, (req, res) => {

res.json({ data: 'This is your paid API response!' });

});

app.listen(3000, () => console.log('Server running on port 3000'));Don’t forget to replace the address with your own Base wallet and integrate a real payment verifier (e.g., using Viem or Alchemy SDK to watch for USDC transfers). This pattern scales beautifully for pay-per-API use cases—clients pay, you deliver! Test it out and let me know if you have questions.

Expect sub-second confirms on Base, fees under a cent. Scale tests with Artillery or k6; x402 handles concurrency without custom queues. Once green, migrate to mainnet by swapping chain IDs and funding real USDC. Coinbase’s facilitator scales automatically, processing that $50 million monthly volume without hiccups.

Deploying to Production and Scaling Your x402 API

Host on Vercel, Render, or Railway for zero-downtime. Secure with rate limits post-payment to thwart abuse. For high-volume, like AI inference APIs, batch intents or tier pricing: 0.01 USDC base, bonuses for volume. Monitor via Etherscan on Base (chain ID 84532) or CDP analytics.

| Network | Fees (USDC) | Confirm Time | Best For |

|---|---|---|---|

| Base Mainnet | and lt;$0.01 | and lt;1s | Production APIs |

| Base Sepolia | Free | and lt;2s | Testing |

| Solana (New) | and lt;$0.001 | and lt;1s | High TPS |

Pro tip: use webhooks for post-settlement events, enabling dynamic refunds or upsells. As COIN holds strong at $164.32 amid 16.47% gains, x402’s traction signals broader adoption. Pair with pay-as-you-go strategies for sustainable revenue.

Best Practices and Future-Proofing Your Integration

Opinion: x402 isn’t just tech; it’s web3’s payment UX breakthrough. Support multi-token (USDC, USDT) and chains via optional fields. Audit your payment objects for compliance-fees, descriptions must be crystal clear. Educate users with client-side modals explaining the flow.

- Implement idempotency keys to avoid double-pays.

- Circuit breakers for facilitator downtime (rare, but Coinbase’s uptime is stellar).

- Analytics: track call volume vs. revenue in CDP.

For agents, embed x402 in langchain tools; autonomous economies await. Dive deeper with HTTP API payment guides. With x402 powering $50M monthly and Base’s speed, your http 402 api payments setup positions you ahead of the curve. Deploy today, monetize tomorrow-build that revenue engine on Base.