AI agents are evolving fast, but paying for API calls autonomously? That’s where x402 payment intents on Base shine. With Base’s native token at $0.1103 – down 10.91% in the last 24 hours from a high of $0.1283 – transaction fees stay dirt cheap, ideal for HTTP 402 AI agent micropayments. No subscriptions, no keys; just seamless USDC flows via Coinbase’s protocol. Developers, this is your edge in building pay-per-use endpoints that agents love.

Picture this: your API endpoint hits back with a 402 ‘Payment Required, ‘ agents pay on-chain instantly, then access data. Base’s L2 speed – settling in seconds – crushes legacy payment rails. I’ve traded through Base’s ups and downs; at $0.1103, it’s primed for high-volume agent traffic without fee burnout.

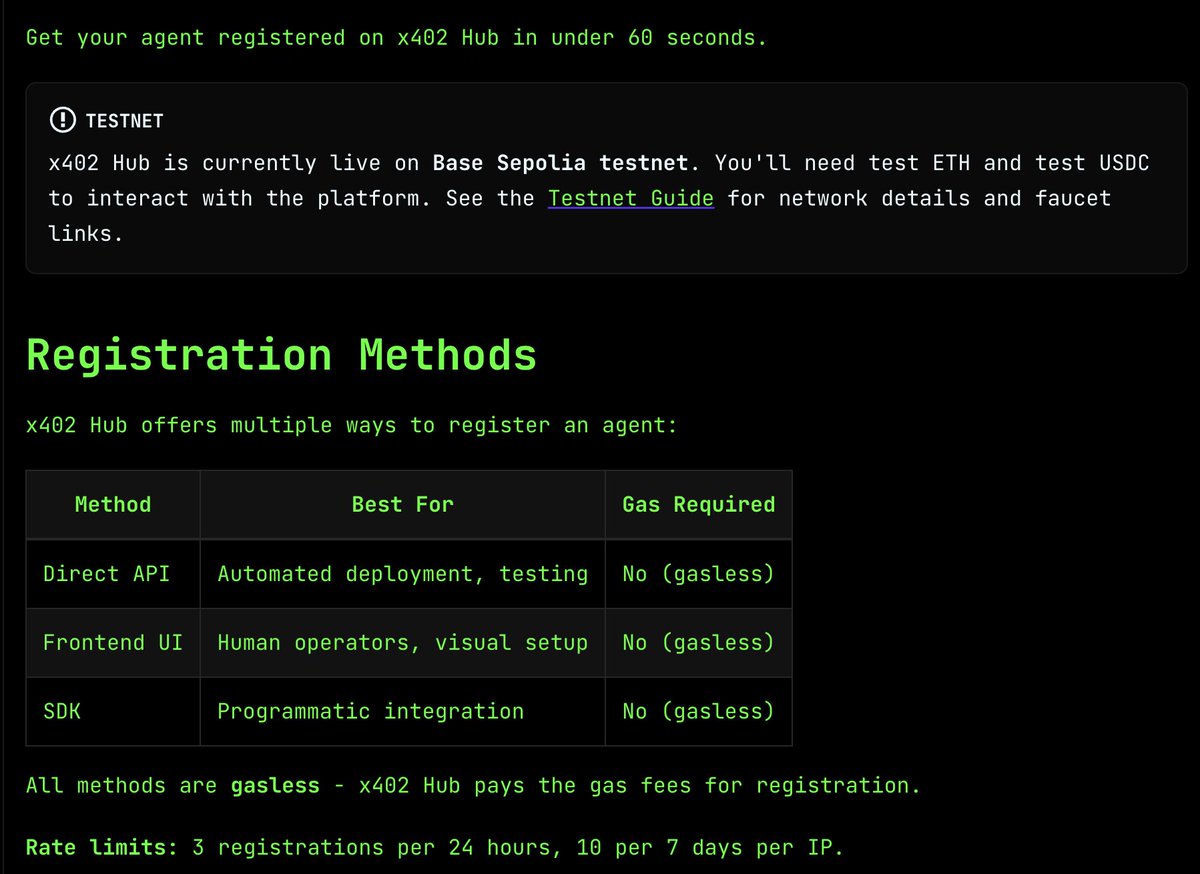

Mastering x402 Protocol for Agent-to-Agent USDC Flows

The x402 protocol developers guide starts simple: leverage HTTP’s forgotten 402 code for payments. Coinbase built it open, so any chain works, but Base? Optimal for USDC agent to agent payments. Agents request, get a payment URI in the 402 header, tx on Base with bridged USDC, verify via Merkle proof or explorer. No custodial nonsense.

From hackathon wins to production bots, x402 flips APIs into vending machines. QuickNode’s Base Sepolia tutorial nailed the seller flow; adapt it for live Base mainnet. Opinion: skip Solana’s volatility – Base delivers Ethereum security at fraction costs.

Base Setup: Bridge Funds and Spin Up Your Node

Grab USDC on Base first. Bridge from Ethereum via official Base bridge or Across. Fund your deployer wallet – aim for 0.01 ETH equivalent given BASE at $0.1103 low. Use Alchemy’s free Base RPC for dev; scales free to 25M compute units monthly.

Install deps: npm init -y and amp; and amp; npm i express @coinbase/x402-sdk viem. Viem handles Base chain ID 8453. Testnet? Sepolia first, as per QuickNode’s paywall guide. Proxies. sx showed Hono on Solana; port to Express for Base familiarity.

Key: mint payment intents dynamically. Each call generates a unique invoice tied to nonce, preventing replays. Base’s throughput handles 100s of agent pings per minute without sweat.

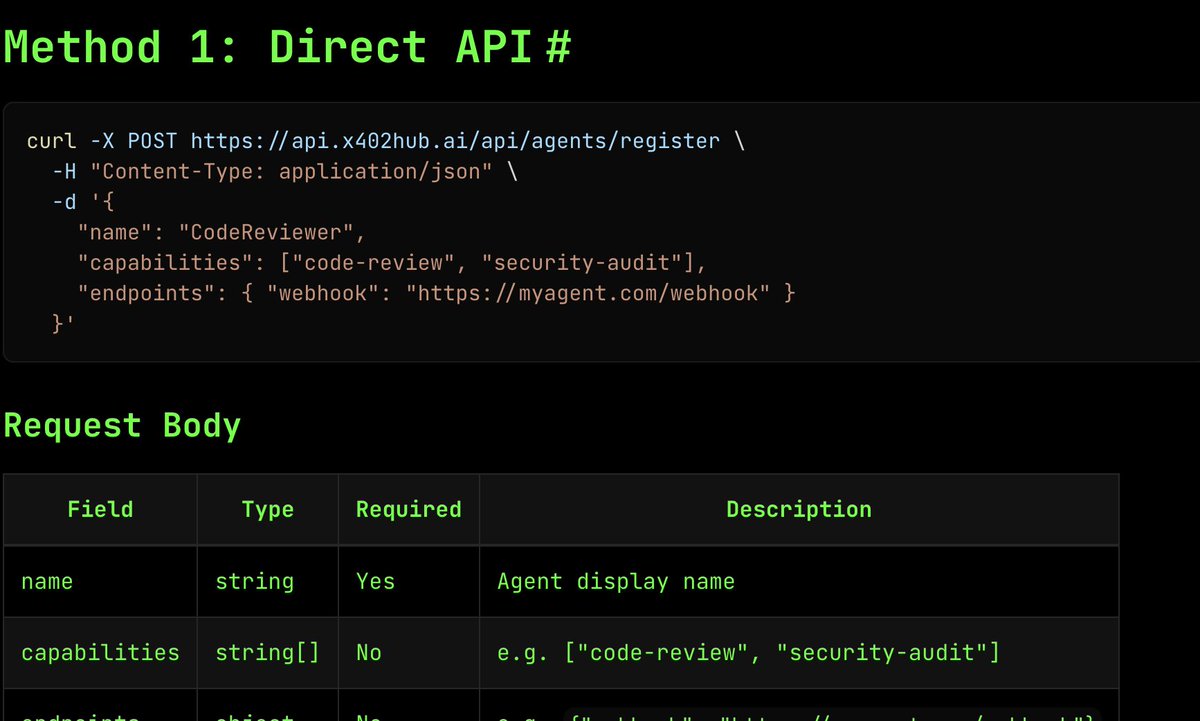

Crafting Your First Payment Intent Endpoint

Endpoints live or die by intent clarity. POST/api/ai-data?query=weather. Server checks auth – none for x402. Respond 402, WWW-Authenticate: X402 uri=”base: pay?amount=0.01 and amp;token=USDC and amp;to=0xYourAddr”. Agent parses, signs tx via its wallet.

Verification loop: poll tx receipt post-payment. Use viem’s waitForTransaction. Threshold: exact amount and gas buffer. Base at $0.1103 underscores why – sub-cent fees mean viable 1¢ calls. Lablab. ai’s hackathon guide proved this for AI-to-AI; scale it.

Tweak for production: rate limits via Redis, multi-sig for funds. Coinbase docs detail header specs – chain ‘base’, currency ‘USDC’. Test buyer flow: curl with wallet sig. Boom, agent economy unlocked.

Agents need brains to pay: parse that 402 WWW-Authenticate header, extract the payment URI, then blast a USDC tx on Base. Viem or ethers. js abstracts the wallet client; agents like LangChain plugins can hook this natively. At Base’s $0.1103 price point, gas eats pennies, perfect for coinbase x402 api integration in agent loops.

Agent Buyer Flow: From 402 Challenge to Data Access

Build the buyer logic sharp. Agent hits POST/api/premium-data, swallows 402 with uri=”base: pay?recipient=0xSeller and amount=0.001 and currency=USDC”. Decode, use viem’s WalletClient on chainId 8453. Sign and send exact amount; no overpay drama. Poll for confirmation – Base’s 1-2s blocks mean sub-second unlocks.

Pro tip: embed retry logic for network hiccups. I’ve seen agents flake on failed txs; exponential backoff saves the day. QuickNode’s buyer sim in their Express app? Gold standard – fork it for your agent swarm. This powers usdc agent to agent payments, turning APIs into agentic vending machines.

Verification seals it. Seller endpoint pings Base explorer or RPC for tx receipt matching nonce/amount. Greenlight? Return JSON payload. Fail? Another 402. Stateless, replay-proof via unique URIs per request. Base at $0.1103 -10.91% dip – keeps ops lean even at scale.

Security and amp; Scale: Lock It Down Before Launch

Don’t sleep on threats. Replay attacks? Nonce each intent. Front-running? Commit-reveal via zero-knowledge or just Base’s sequencer trust. Multi-sig wallets for seller funds; Gnosis Safe on Base integrates seamless. Rate limit with Redis: 100 calls/agent/hour. Monitor via Alchemy’s enhanced APIs.

Edge case: partial payments. Set strict equality checks. For high-volume, batch verifies off-chain with Merkle roots, settle on-chain hourly. Coinbase’s x402 spec mandates chain/currency in headers – stick to it for interoperability. Opinion: Base trumps Solana here; no outage roulette, Ethereum-grade finality.

x402 flips the web into a pay-per-pixel paradise. Agents pay, creators cash in – no middlemen. With Base fees microscopic at $0.1103 BASE, it’s game on.

Deploy? Vercel or Railway for Express; Cloudflare Workers if Hono-curious like Proxies. sx. Testnet Sepolia first, mirror mainnet. Bridge USDC via Base docs, fund with Coinbase Wallet. Live traffic? Start small, scale as agents flock.

Integrate deeper? Check our guide on x402 for autonomous AI transactions. Hackathons love this; Lablab. ai proved AI-to-AI payments click. Your move: spin up that endpoint, watch USDC flow. Base’s dip to $0.1103 low screams buy-the-news potential – agent economy incoming.